HUDSON Online Practice Test

HUDSON, a global leader in talent solutions, is known for its rigorous assessment process designed to identify top talent. If you’re preparing for a career at HUDSON or a similar organization, you’ll likely encounter the HUDSON Practice Aptitude Test Pack. These assessments play a pivotal role in evaluating your cognitive abilities, critical thinking, and problem-solving skills. In this blog post, we’ll delve into the world of HUDSON assessments, providing insights, strategies, and tips to help you excel.

Understanding the HUDSON Practice Test

The HUDSON Practice Aptitude Test Pack is carefully designed to assess a wide range of cognitive abilities, critical thinking skills, and problem-solving capabilities. These assessments are instrumental in identifying candidates who have the potential to excel in the dynamic world of talent solutions. Your performance in these tests can significantly impact your candidacy for a role at HUDSON.

Tips for Excelling in the HUDSON Practice Aptitude Test Pack

- Master the Test Format: Begin by gaining a clear understanding of the format of the test and the types of questions you’ll face. HUDSON often provides practice materials and sample questions for your preparation.

- Effective Time Management: Managing your time wisely during the test is crucial. Allocate specific time limits for each question or section to ensure you complete all parts of the assessment.

- Regular Practice: Consistent practice is key to success. Utilize HUDSON’s practice materials and seek additional resources to sharpen your skills.

- Foundation Knowledge: Ensure your foundational knowledge in mathematics, language, and logical reasoning is strong. This will provide a solid base for tackling the test questions.

About HUDSON company

Hudson discovers talent and helps people realize their career potential roles to create that perfect ‘fit’ fuels business success and transforms people’s lives. HUDSON mostly uses Watson Glaser-style tests for its candidate selection. The sections on the assessments may include any of the following test sections, depending on the role that you applied to and also the country you are applying from:

- Written Exercise

- Case Study

- Situational Judgement Test

- Presentation

- Proof Reading Test

- Personality Test

Key Components of the HUDSON Practice Aptitude Test Pack

- Numerical Reasoning: This component evaluates your ability to interpret numerical data, analyze financial information, and make data-driven decisions. Expect questions involving data analysis, percentages, and ratios.

- Verbal Reasoning: In this section, your language skills, comprehension, and logical reasoning abilities are evaluated. You’ll encounter passages of text and questions related to them, showcasing your ability to extract relevant information and make sound judgments.

- Abstract Reasoning: The abstract reasoning section assesses your non-verbal reasoning skills. You’ll be tasked with identifying patterns, sequences, and relationships among abstract shapes or symbols.

- Situational Judgment Test (SJT): The SJT evaluates your decision-making and problem-solving skills in real-world work scenarios. You’ll be presented with workplace situations and asked how you would respond, with a focus on ethical and practical considerations.

Sample HUDSON Assessment Practice Tests and Worked solutions

HUDSON Graduate Practice pack Verbal Reasoning

In the past 12 months, benefit fraud has fallen by £½ billion to its lowest level for over a decade. The fall is equivalent to a 25 percent drop to 1.5 percent of the total £100 billion benefit bill. This spectacular fall follows permission for the benefits office to access Inland Revenue taxation data. Benefit officers can now immediately check to see if a claimant is working and claiming benefits intended only for those out of work. This new measure has led to over 80,000 people being caught making false claims.

A similar initiative has also succeeded in a substantial cut in the level of fraud committed by claimants of housing benefits. Local authorities are responsible for the administration of this allowance which is awarded to the unemployed and low-paid to help with housing costs. Until recently local authority staff had been unable to access central government records to check the information provided by claimants. These checks have so far identified 44,000 claimants who have provided false information in order to make claims for allowances for which they are not eligible.

Question 1.

By making it possible to share information, over 120,000 cases of fraud have been detected.

A. True

B. False

C. Cannot tell

Question 2.

Ten years ago the level of benefit fraud was higher.

A. True

B. False

C. Cannot tell

Question 3.

Only the unemployed should legitimately claim these benefits.

A. True

B. False

C. Cannot tell

Question 4.

The tone of the passage suggests that these reductions in fraud are a good thing.

A. True

B. False

C. Cannot tell

Question 5.

A year ago the level of benefit fraud totaled £2 billion.

A. True

B. False

C. Cannot tell

Answers

Question 1. A, Explanation: 80,000 by benefit officers and 44,000 by local authorities;

Question 2. B, Explanation: The passage states that the new lower total was the lowest for 10 years so the level must have been lower 10 years ago;

Question 3. B, Explanation: Housing benefit is also awarded to the low-paid;

Question 4. A, Explanation: In the passage, the fall in false claims is described as spectacular;

Question 5. A, Explanation: The passage states that the £½ billion drops is equivalent to 25%, so the level of fraud 12 months previously would have been £2 billion. 50 Ultimate psychometric tests

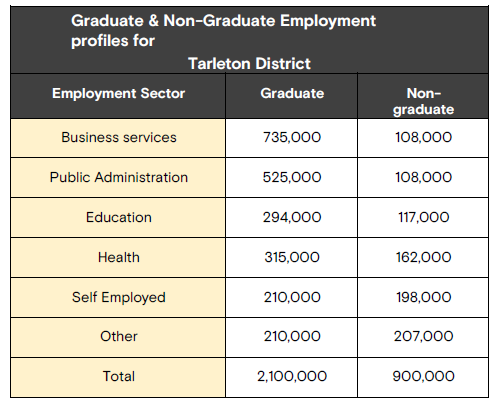

HUDSON Graduate Practice pack Numerical Reasoning

GET THE PREMIUM VERSION

Question-1

Approximately what percentage of graduates and non-graduates are self-employed?

A. 10%

B. 14%

C. 17%

D. 22%

E. 23%

EXPLANATION Self-employed graduate = 210,000 Self-employed non-graduate = 198,000 and the total = 408,000 Total = 2,100,000 = 900,000 = 3,000,000 Approximate percentage = 408,000/3,000,000 x 100 = 13.6% ≈ 14% Answer: (A)

Question-2

If the number of graduates employed in Health is forecast to decline by 20% year-on-year while the number of non-graduates is forecast to remain the same, how many years will it take for non-graduate employees to outnumber graduate employees in Health?

A. 1

B. 2

C. 3

D. 4

E. 5

EXPLANATION 1st year decline by 20% in health for graduates = 20/100 x 315,000 = 63,000, 315,000 – 63,000 = 252, 000

2nd year decline by 20% in health for graduates = 20/100 x 252,000 = 50,400, 252,000– 50,400 = 201,600,

3rd year decline by 20% in health for graduate = 20/100 x 2101,600 = 40,320, 201,600 – 40,320 = 161280, so if required 3 years. Answer: (C)

Question-3

If the number of graduates employed in Education remains the same while the number of non-graduates increases by 15% per year, how many years will it take for the number of nongraduates to exceed the number of graduates employed in education?

A. 3

B. 4

C. 5

D. 6

E. 7

EXPLANATION 1st year 15% increase for non-graduate in education 0.15 x 117,000 = 17,550, 117,000+17,550 = 134,550,

2nd year 15% increase for non-graduate in education 0.15 x 134,550 = 20,182.5, 134,550 + 20,182.5 = 154,732.5 3rd year 15% increase for non-graduate in education 0.15 x 154,732.5 = 23, 209.875, 23,209.875+154,732.5 = 177,942.375

4th year 15% increase for non-graduate in education 0.15 x 177,942.375 = 26,691.35, 26,691.35+177,942.375 = 204,633.73

5th year 15% increase for non-graduate in education 0.15 x 204,633.73 = 30,695.06, 30,695.06+204,633.73 = 235,328.79

6th year 15% increase for non-graduate in education 0.15 x 235,328.79 = 35299.32, 35299.32+235,328.79 = 280,628.11

7th year 15% increase for non-graduate in education 0.15 x 270,628.11 = 40,594.22, 40,594.22+270,628.11 = 311,222.33 is the year 7th Answer: (E)

GET THE PREMIUM VERSION

Question-4

What is the number of self-employed graduates as a proportion of the total number of individuals in Tarleton district?

A. 3%

B. 4%

C. 5%

D. 6%

E. 7%

EXPLANATION Self-employed graduate = 210,000 Total individual = 210,000+900,000 = 3,000,000 Proportion = 210,000/3,000,000 x 100 = 0.07 x 100 = 7% Answer: (E)