HMRC Online Practice Test

Her Majesty’s Revenue and Customs (HMRC) is the UK government department responsible for collecting taxes, ensuring tax compliance, and administering various tax-related policies. For individuals aspiring to embark on a career in taxation, customs, or public service, the HMRC Practice Aptitude Test is a significant hurdle in the application process. In this blog post, we’ll delve into what the HMRC Practice Aptitude Test entails, why it’s essential, and how you can effectively prepare to pave your way to a successful and impactful career in tax administration.

Understanding the HMRC Practice Aptitude Test

The HMRC Practice Aptitude Test is a rigorous assessment designed to evaluate a candidate’s cognitive abilities, problem-solving skills, and suitability for roles within the HMRC, including tax officers, compliance specialists, and customs officers. It comprises various sections, including numerical reasoning, verbal reasoning, situational judgment, and critical thinking. HMRC employs this test to identify individuals who not only possess the requisite qualifications but also exhibit the aptitude to excel in roles related to tax administration and public service.

Why is it Important?

- Gateway to Public Service: Excelling in the HMRC Practice Aptitude Test is your key to entering the world of public service. Working for HMRC means contributing directly to the financial stability and welfare of the country.

- Competitive Advantage: In a competitive job market, a strong performance in this aptitude test can give you a distinct advantage. It demonstrates your ability to analyze complex tax-related scenarios, make informed decisions, and navigate the intricate landscape of tax administration—qualities highly valued by HMRC.

- Skills Validation: The test provides insights into your cognitive strengths and areas that may require improvement. This self-awareness can guide your career choices and help you focus on honing specific skills.

- Career Alignment: The results can assist you in aligning your career aspirations with your abilities. Whether you’re interested in tax policy, customs and excise, or tax compliance, the HMRC test can help you identify the most suitable career path within the organization.

Preparing for Success

- Understanding the Test Format: Start by familiarizing yourself with the structure of the HMRC Practice Aptitude Test, including the types of questions and time limits for each section.

- Regular Practice: Consistent practice is crucial. Solve sample questions, take mock tests, and use practice resources provided by HMRC to enhance your problem-solving skills and time management.

- Situational Judgment: Pay special attention to the situational judgment section, as it assesses your ability to make ethical decisions in real-world scenarios related to tax administration.

- Time Management: During the actual test, efficiently manage your time. Don’t get bogged down by a single question or section; move forward and return to it later if necessary.

- Seek Guidance: Consider enrolling in a test preparation course or consulting with career advisors who can provide valuable strategies and insights tailored to HMRC Aptitude Tests.

HMRC Aptitude tests formats; What to expect:

HMRC mostly uses CEB/Gartner (SHL) style tests for its candidate selection. The sections on the assessments may include any of the following test sections, depending on the role that you applied to and also the country you are applying from:

- Numerical Reasoning

- Verbal Reasoning

- Diagramatic

- Presentation

- Interview

- Personality Test

Sample HMRC Assessment Practice Tests and Worked Solutions

GET THE PREMIUM VERSION

Numerical Reasoning

Question 1

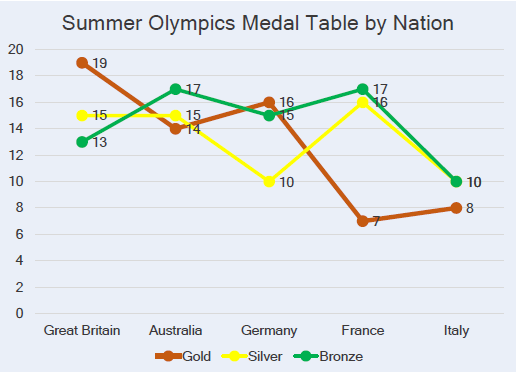

What proportion of the medals won by France are Silver?

A. 20%

B. 30%

C. 40%

D. 50%

E. 60%

EXPLANATION The total medals won by France are: Gold = 7, Silver = 16, Bronze = 17. Total = 40, therefore the proportion of Silver won by France Is 16/40 x 100 = 40%. Answer: (C)

Question-2

What was the percentage difference in the total silver medals won between Australia and bronze medal won by Italy?

A. 33%

B. 30%

C. 25%

D. 39%

E. 60%

EXPLANATION Percentage difference of total silver won by Australia and bronze won by Italy? Bronze by Italy = 10, Silver by Australia = 15, Therefore = (15 – 10)/15 x 100- = 33%. Answer: (A)

Question-3

What proportion of the medals won by Germany is gold?

A. 35%

B. 38%

C. 27%

D. 39%

E. 30%

EXPLANATION The proportion of medical that is gold won by Germany is Total medal won by Germany = 16 15 10 = 41 medals = 16/41 x 100 = 39.02% ≈ 39%. Answer: (D)

GET THE PREMIUM VERSION

Verbal Reasoning

People assume that they go to the hospital to get well. However, in the past few years, this perception has been challenged by the real risk of acquiring a deadly infection while in hospital. As a consequence, public confidence in the health service has suffered. An antibiotic-resistant the strain of bacteria was first identified in the 1950s. It was a staphylococcus common in abscesses and bloodstream infections and it had become resistant to the antibiotic penicillin.

Since then the bacteria have become resistant to a second antibiotic and have become established as a source of infection in many nursing homes and hospitals. Today it is believed to cause about 1,000 deaths each year as a result of hospital-acquired infections. Action that can beat this ‘superbug’ is simple but expensive. It requires very high levels of hygiene and cleanliness and a program of testing so that infected patients can be isolated and treated.

Question 1.

Staphylococcus infections kill around 1,000 people a year.

A. True

B. False

C. Cannot tell

Question 2.

If clean hospitals had been a priority in the 1950s we would not face this threat today.

A. True

B. False

C. Cannot tell

Question 3.

Staphylococcus became established as a source of infection in many nursing homes and hospitals in the 1950s.

A. True

B. False

C. Cannot tell

Question 4.

Staphylococcus has become a ‘superbug’.

A. True

B. False

C. Cannot tell

Question 5.

Infections of the bloodstream are more serious than abscesses.

A. True

B. False

C. Cannot tell

Answers

Question 1. B, Explanation: The 1,000 deaths result from hospital-acquired infections;

Question 2. C, Explanation: The passage provides no information on how the antibiotic-resistant bacteria might have been countered in the 1950s;

Question 3. B, Explanation: The passage states that the infection became established in hospitals and nursing homes since that time;

Question 4. A, Explanation: The term is used to describe it in the passage;

Question 5. C, Explanation: The passage does not provide information on the relative severity of these conditions.