Slaughter & May Online Practice Test

Slaughter & May is a globally renowned law firm known for its excellence and commitment to legal practice. Aspiring legal professionals often set their sights on joining this prestigious firm. As part of their rigorous selection process, candidates may encounter the Slaughter & May Practice Aptitude Test. In this blog post, we’ll explore what the Slaughter & May Practice Aptitude Test entails, why it’s crucial, and how you can prepare effectively to embark on a successful career in law.

Understanding the Slaughter & May Practice Aptitude Test

The Slaughter & May Practice Aptitude Test is a comprehensive assessment designed to evaluate a candidate’s cognitive abilities and problem-solving skills, particularly within a legal context. It encompasses various domains, including numerical reasoning, verbal reasoning, logical reasoning, and critical thinking. Slaughter & May uses this test to identify individuals who not only meet the qualifications but also possess the aptitude to excel in the legal field.

Preparing for Success

- Understanding the Test Format: Start by familiarizing yourself with the structure of the Slaughter & May Practice Aptitude Test, including the types of legal questions and time limits for each section.

- Regular Practice: Consistent practice is crucial. Solve sample legal questions, take mock tests, and use practice resources provided by Slaughter & May to improve your problem-solving skills and time management.

- Time Management: During the actual test, efficiently manage your time. Don’t get bogged down by a single question or section; move forward and return to it later if necessary.

- Seek Guidance: Consider enrolling in a test preparation course or consulting with career advisors who can provide valuable strategies and insights tailored to legal aptitude tests.

- Review and Learn: After each practice test, review the legal questions you answered incorrectly. Understand where you made mistakes and use those lessons to enhance your performance.

About Slaughter and May company

Slaughter and May Aptitude tests formats; What to expect:

Slaughter and May mostly uses Cut-e Assessment style tests for its candidate selection. The sections on the assessments may include any of the following test sections, depending on the role that you applied to and also the country you are applying from:

- Numerical Reasoning

- Verbal Reasoning

- Diagramatic

- Interview

- Personality Test

Slaughter & May Assessment Practice Tests and Worked solutions

Question 1

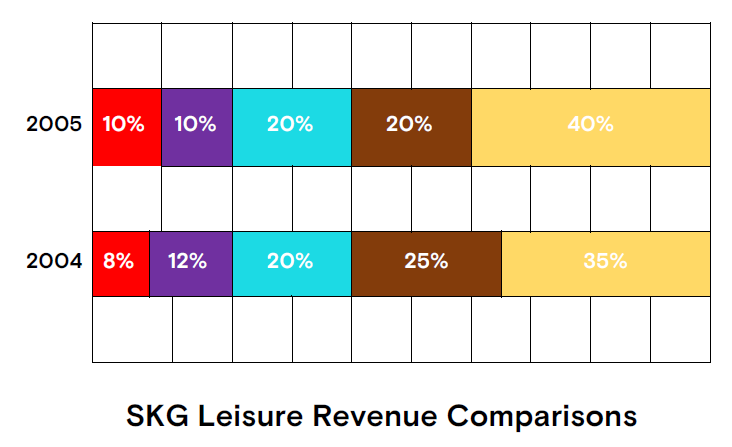

If the revenue for Car Rental in 2004 was half that for Hotels in 2005 when Holiday Lettings accounted for 5.04m Euros, what was the revenue from Hotels in 2004?

A. 0.84m

B. 1.05m

C. 1.26m

D. 2.10m

E. 2.52m

EXPLANATION Let the revenue for car rental in 2004 be x Let the hotel in 2005 be y Holidays lettings = 5.04m Therefore in 2015 = 40/100 x y = 5.04m Y = 5.04/ 0.4 = 12.6m, where y in the total revenue in 2005 Therefore, the revenue for hotel y in 2005is given by 20/100 x 12.6 = 2.52m Euros Since x for car rental in 2004 equal half hotels that is x = ½ x 2.52 = 1.26m Euros The revenue of car rental in 2004 is 1.26m Euros.

Answer: (C)

Question 2

If Other Revenue grew by 50% to 1.26m in 2005, approximately how much revenue did Holiday Lettings generate in 2004?

A. 1.05m

B. 1.26m

C. 2.52m

D. 2.63m

E. 3.68m

EXPLANATION Other revenue increased by 50% to 1.26m in 2005 The initial amount for other revenue is 10% For 50% increase = 0.5 x 0.1 x x 0.1 x x = 1.26, where x is the total revenue in 2005 0.15x = 1.26, x = 8.4m Euros Therefore 0.1 x 8.4 = 0.08 x y, where y is the total revenue in 2004 0.84 = 0.08y, y = 10.5m Euros Since holiday and lettings in 2004 = 0.35 x 10.5 = 3.675 ~ 3.68m.

Answer: (E)

Question 3

If starting from 2004, Hotel revenue grew by 20% year on year to 2.26m in at2007, approximately how much revenue did hotel revenue account for as of 2004? A. 1.16m B. 1.26m C. 1.52m D. 1.63m E. 1.68m EXPLANATION 16 Seconds year 2004 and hotel revenue = 20% of x, where x is the revenue at 2004: 0.2 x x = 0.2x Year 5 is 20% increase = 20% of 0.2x 0.2x 0.2 x 0.2x 0.2x = 0.24x Year 2006 = 0.2 x 0.24x 0.24x = 0.288x Year 2007 = 0.2 x 0.288x 0.288x = 2.26m 30.3456x = 2.26m,, x = 6.539m Therefore the revenue for 2004 = 0.2 x 6.53m =1. 31m (1.26 is safe) Answer: (C)

Question 4 If Travel Revenue grew by 30% to 1m in 2005, approximately how much revenue did Holiday Lettings generate in 2004?

A. 1.05m

B. 1.26m

C. 1.54m

D. 2.63m

E. 3.68m

EXPLANATION 3rd in 2004, travel revenue = 0.35x, where x is the total revenue In 2005 is 30% increase = 0.30 x 0.25x 0.25x = 1m, 0.325x = 1 Total revenue for x = 3.077m in 2004 Therefore holiday lettings revenue = 0.35 x 3.077 = 1.05. Answer: (A)

Slaughter & May Graduate Practice pack Verbal Reasoning

In the past 12 months, benefit fraud has fallen by £½ billion to its lowest level for over a decade. The fall is equivalent to a 25 percent drop to 1.5 percent of the total £100 billion benefit bill. This spectacular fall follows permission for the benefits office to access Inland Revenue taxation data. Benefit officers can now immediately check to see if a claimant is working and claiming benefits intended only for those out of work. This new measure has led to over 80,000 people being caught making false claims. A similar initiative has also succeeded in a substantial cut in the level of fraud committed by claimants of housing benefits. Local authorities are responsible for the administration of this allowance which is awarded to the unemployed and low-paid to help with housing costs. Until recently local authority staff had been unable to access central government records to check the information provided by claimants. These checks have so far identified 44,000 claimants who have provided false information in order to make claims for allowances for which they are not eligible.

Question 1. By making it possible to share information, over 120,000 cases of fraud have been detected.

A. True

B. False

C. Cannot tell

Question 2.

Ten years ago the level of benefit fraud was higher.

A. True

B. False

C. Cannot tell

Question 3. Only the unemployed should legitimately claim these benefits.

A. True

B. False

C. Cannot tell

Question 4.

The tone of the passage suggests that these reductions in fraud are a good thing.

A. True

B. False

C. Cannot tell

Question 5.

A year ago the level of benefit fraud totaled £2 billion.

A. True

B. False

C. Cannot tell

Answers

Question 1. An Explanation: 80,000 by benefit officers and 44,000 by local authorities;

Question 2. B, Explanation: The passage states that the new lower total was the lowest for 10 years so the level must have been lower 10 years ago;

Question 3. B, Explanation: Housing benefit is also awarded to the low-paid;

Question 4. An Explanation: In the passage, the fall in false claims is described as spectacular;

Question 5. An Explanation: The passage states that the £½ billion drop is equivalent to 25%, so the level of fraud 12 months previously would have been £2 billion. 50 Ultimate psychometric tests